Following customers as they wander off from their television sets, big brand advertisers are starting to divert TV ad budgets to online video–or at least they intend to.

That’s one of the most interesting findings in video ad exchange Adap.TV’s semiannual “State of the Video Industry” report conducted with the digital media site Digiday. Of course, it would be fair to assume that Adap.TV, which was acquired by AOL in August for $405 million and recently helped AOL AOL -3.34% unseat Google GOOG -1.45% as the biggest seller of video ads online, would be seeing trends like this perhaps more than a disinterested party. But it polled some 900 ad agencies, advertisers, ad networks, and publishers, so it’s worth paying attention to.

Not surprisingly, the study found that video ads are exploding, thanks in part to automated technologies to make the buying process faster and easier as well as a jump in the amount of live and on-demand content coming to all screens. This year, brands upped their video ad budgets by 65% from 2012. Some 86% of brands and 91% of agencies expect to spend more on them next year.

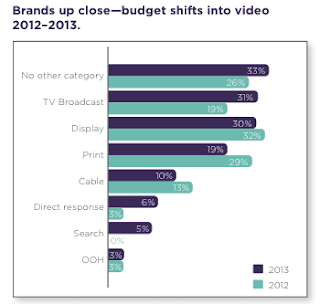

The study found that 31% of brands see video ad budgets coming from broadcast TV, 13% from cable TV. Display, which to date has been the main target and may well continue to be for years to come, was cited by 30% of brands. “People aren’t watching reliably in front of their TV screens anymore,” instead watching on multiple screens, Adap.TV Chief Marketing Officer Kara Weber said in an interview. “It’s shifting how brands are looking to reach consumers.”

Throw agencies, which constitute the largest segment polled at 43% of respondents, into the mix with brands, and the percentages change considerably. So it’s probably risky to extrapolate the results of this study to actual budgets shifts. Some 21% of agencies and brands together see budgets coming from broadcast, 11% citing cable. Instead, brands agencies overall saw big increases in budgets coming from out-of-home advertising such as billboards and search advertising. Brands see very little shift to online video coming from search because they view search ads as a good way to drive more people to their online video.

Only 3% of brands and agencies taken together cited display, which seems odd. However, Weber said that’s likely the result of agencies still being organized with separate TV and digital operations, so budgets don’t flow freely between the operations.

All that said, Adap.TV cautions that any change won’t be large or quick:

Another big trend is the way these video ads are bought–via automated buying known as programmatic. “In just the past two years, brand patronage of programmatic video channels such as exchanges and DSPs has roughly doubled, as direct to publisher purchases have declined by 15 percent,” the report says. A lot more advertisers and agencies are also buying mobile ads than they were three years ago.Looking still more closely at how much broadcast budgets could shift in the coming year, it’s important to note that this year 42 percent of all video advertising buyers said there had been no change in their broadcast spending whatsoever. So, while they say a change is likely in 2014, it may not necessarily come to fruition. Furthermore, the largest group of buyers says the decline was 10 percent or less of their broadcast budgets. These numbers will continue to fluctuate as buyers examine their efforts in TV, digital and mobile video, and how that translates into a media mix that adapts with the rapidly converging nature of those worlds.

But there remains at least one big obstacle to the movement of TV ad budgets to online video: a lack of universal metrics for determining how the reach, targeting, and performance of video ads. “Audience guarantees online were expected to be a game-changer for the ‘TV-ization’ of online video,” the study says. “Yet some 65 percent of brands and 70 percent of agencies say that existing measurement standards do not satisfy their need for audience guarantees.” - Robert Hof, Forbes

No time? No Resources? Not sure where to start?

Call Jeff at 888-712-8211 today!

VMakers - Video made easy.

Trusted by Disney, Warner Bros, NBC, Paramount, CBS and ABC.

info@VMakers.com

If you are looking for a solid contextual ad network, I recommend you have a look at PropellerAds.

ReplyDelete